39 defined contribution pension death

Inherited Pension Benefit Payments From Deceased Parents A defined-contribution plan is a retirement plan that's typically tax-deferred, like a 401 (k) or a 403 (b) , in which employees contribute a fixed amount or a percentage of their paychecks to an... Pension fund - Wikipedia The pension system in Romania is made of three pillars. One is the state pension (Pillar I – Mandatory), the second is a private mandatory pension where the state transfers a percentage of the contribution it collects for the public pension, and the third is an optional private pension (Pillar III – Voluntary).

Home - Civil Service Pension Scheme Introducing the new Civil Service Pensions Website. We have totally redesigned and rebuilt our website from the ground up. Our aim was to make it easier and quicker than ever for you to find the information and support you need to manage, understand and maximise the benefits of your biggest employment benefit after your salary – your Civil Service Pension.

Defined contribution pension death

Options for using your defined contribution pension pot You now have more choice and flexibility in how and when you can take money from your defined contribution pension pot. It’s important to understand your options because what you decide now will affect your retirement income for the rest of your life. How To Get Widows Pension Income After Death Of Spouse The National Pension System (NPS) is a voluntary defined contribution pension system or government-sponsored pension scheme in India (like PPF and EPF). The scheme allows subscribers to contribute regularly to a pension account during their working life. The entire corpus escapes tax at maturity and the entire pension withdrawal amount is tax-free. Considering a pension transfer: defined benefit | FCA Jul 19, 2021 · In a defined contribution (DC) pension, you invest funds to build up a personal pot of money. You can choose how to use your pot to give you allowable tax-free lump sums and your retirement income . The value of your pension pot is affected by changes in the value of the assets you invest in - such as shares, bonds and property - and it will go ...

Defined contribution pension death. DEFINED CONTRIBUTION PENSION - A Complete Guide As with a defined contribution pension, your contributions are tax-free. But like a defined benefit pension, you are guaranteed a certain amount by the pension provider when you ultimately retire. The pension provider has a team of investment managers to earn a return. They put your money to work by investing in shares and other assets. PDF Defined Benefit Plan Beneficiary Nomination Form Your designations on this form apply only to your SERS defined benefit pension. You must file a separate form to designate beneficiaries for any other retirement benefits, including SERS-administered defined contribution and deferred compensation plans. Because SERS will pay your death benefit according to your stated intent, it is search - Pennsylvania State Employees' Retirement System The Pennsylvania State Employees' Retirement System, serving our members since 1923 Defined contribution pensions - BDO Relaxation of tax charges for pension funds on death after age 75 It has long been the case that if an individual dies before taking any pension benefits (and before age 75), the fund remains outside the individual's estate for inheritance tax (IHT) purposes and there is no exit charge on funds paid to their nominated beneficiaries.

Defined Contribution Plan In a defined contribution plan, the employer and employee contribute a set or defined amount and the amount of pension income that the member receives upon retirement is determined by, among other things, the amount of contributions accumulated and the investment income earned.These contributions are often a fixed percentage of an employee's annual earnings and are deposited monthly in an ... Triviality and commuting small pensions for cash Small pensions from both defined benefit and/or defined contribution schemes, payable to a survivor on the death of member can be commuted and paid as a one off lump sum (known as a trivial commutation lump sum death benefit) provided the value of the lump sum in each scheme is no more than £30,000. What happens to my pension when I die? | MoneyHelper Defined benefit pension schemes might also pay a refund of the contributions paid by the member, if the member dies before starting to draw their pension. This is subject to the scheme's rules. Interest might also be added to the refund of contributions under some scheme's rules. Pension protection lump sum Retirement Topics - Death | Internal Revenue Service ERISA protects surviving spouses of deceased participants who had earned a vested pension benefit before their death. The nature of the protection depends on the type of plan and whether the participant dies before or after payment of the pension benefit is scheduled to begin, otherwise known as the annuity starting date.

Pension death benefits 'indefensibly generous' | Financial ... Rule changes in 2015 allowed any unused cash left in a defined contribution personal pension to be passed to beneficiaries and heirs tax free if the pension holder died before the age of 75. Tax on a private pension you inherit - GOV.UK A pension from a defined benefit pot can usually only be paid to a dependant of the person who died, for example a husband, wife, civil partner or child under 23. It can sometimes be paid to... Death benefits from defined contribution schemes Defined contribution schemes usually offer lump sum and income death benefits. Each scheme will define the treatment of benefits on the death of a member and each scheme may be different. Death benefits from occupational defined contribution schemes may not offer full flexibility of death benefits. Defined-Contribution Plan Definition The defined-contribution plan differs from a defined-benefit plan, also called a pension plan, which guarantees participants receive a certain benefit at a specific future date.

Death benefits for defined benefit schemes Defined benefit lump sum death benefits (DBLSDB) This is a lump sum which is paid from a defined benefit arrangement. There is no limit on the level of defined benefits lump sum death benefit that can be paid from a defined benefits scheme. DBLSDB is usually only payable on death before retirement. The amount paid may be:

Defined contribution pension options at retirement ... When you retire from a Defined Contribution Pension Plan, your retirement options are very different than the options from a Defined Benefit Pension Plan. The pension options you have will depend on a few different things but the biggest issues are the amount of money you have in the pension and your age.

What happens to your pension when you die? - Aviva A defined contribution pension — a pension that's based on how much has been paid into it — will normally pay the value of your pension pot in a lump sum to your dependants. If you die before age 75, benefits under money purchase schemes can usually be passed on to your beneficiaries free of tax.

Transfer of Pension Assets - Dynamic Defined Benefit Pension Plan. This is the type of plan where a formula outlines how much you will be paid at retirement. As with Defined Contribution plans, the benefit received by the widow/widower depends on if the death occurred before or after the pension payments begin. Death before pension payments begin. Two options may be available.

Defined Contribution Pension schemes What is a defined contribution pension ? Defined contribution pensions can be: workplace pension schemes set up by your employer, or private pension schemes set up by you. If you're a member of a pension scheme through your workplace, then your employer usually deducts your pension contributions from your salary before it is taxed.

What is a defined contribution pension? | PensionBee What is a defined contribution pension? A defined contribution pension is the most common type of pension. On retirement, the amount your defined contribution pension is worth depends on how much money you've contributed and the performance of your investments. Most modern workplace and personal pensions are defined contribution pensions.

What happens to your pension when you die? | PensionBee Defined contribution pensions The main pension rule governing defined contribution pensions in death is your age when you die and whether you've already started drawing your pension. If you die before your 75th birthday and haven't started drawing your pension it can be passed to your beneficiaries tax-free.

Pension contribution limits | PensionBee Jul 07, 2021 · Up to the pension contribution limit, you receive generous pension tax relief on your contributions. The amount you receive depends on your income tax bracket: you automatically get a 25% tax top up, but you can claim a further 25% or 31% through your tax return if you’re a higher or additional rate taxpayer.

Pension Funds Novartis · Death Spouse's pension (where applicable also for divorced persons) Domestic partner's pension Orphan's pension Lump sum payments If an insured person dies before reaching the age of 65, a lump sum on death will be paid out to the beneficiary. Provisions stipulated in the regulation Regulations of Novartis Pension Fund 1 (Art. 10 Para. 3 to Art. 15, Art.

Death Benefits - Defined Contribution Schemes Death Benefits - Defined Contribution Schemes. ... How pension death benefits are treated depends on the age at death and the timeframe with which any death benefits are paid out. Death benefits and the Lifetime Allowance A lifetime allowance charge may apply to benefits where:

Death benefits from a defined benefit pension scheme | Tax ... Death benefits from a defined benefit pension scheme Introduction. On the death of a scheme member or a beneficiary, a registered pension scheme is only authorised to pay out benefits to a beneficiary either as a pension death benefit or as a lump sum death benefit.

Pensions and inheritance - Unbiased.co.uk This assumes you have a defined contribution (money purchase) pension scheme, which is the case for most workplace pensions and all private pensions. Note that this only holds true if you have unspent pension pot remaining.

What is a defined benefit pension? | Final salary pension Dec 08, 2021 · A defined benefit pension (also called a 'final salary' pension) is a type of workplace pension that pays you a retirement income based on your salary and the number of years you’ve worked for the employer, rather than the amount of money you’ve contributed to the pension.

PDF Defined Contribution Pension Plan Death Benefit Application Defined Contribution Pension Plan Death Benefit Application _____ Complete all applicable sections and return pages 1-3 to: Southern California Pipe Trades Administrative Corporation Defined Contribution Department 501 Shatto Place, 5th Floor Los Angeles, CA 90020 Save "Your Rollover Options" for your records. (800) 595-7473 OR (213) 385-6161

What happens to my pensions after death? | The Private Office If you have built up substantial funds in your pensions during your working life and have not taken any benefits from them and subsequently die before your 75th birthday your defined contribution pension funds and any defined benefit lump sums will be tested against your Lifetime Allowance.

Defined Contribution Pension Plan (DC) | Human Resources ... The Defined Contribution (DC) Component of the University of Winnipeg Trusteed Pension Plan was established effective January 1, 2000. The purpose of the Defined Contribution Pension Plan is to help you save for retirement. The Plan provides investment options, tax sheltering of assets and investment earnings until retirement.

Defined Contribution Pension Plan in Canada: Complete Guide The defined contribution pension plan (DCPP) in Canada is a tricky topic for many people. It's the most common type of pension offered by employers today, so it's an important thing to understand. This article will go over all the ins-and-outs of a defined contribution pension plan in Canada

Defined contribution schemes - The Pensions Authority Defined contribution schemes Defined contribution (DC) schemes are occupational pension schemes where your own contributions and your employer's contributions are both invested and the proceeds used to buy a pension and/or other benefits at retirement.

Considering a pension transfer: defined benefit | FCA Jul 19, 2021 · In a defined contribution (DC) pension, you invest funds to build up a personal pot of money. You can choose how to use your pot to give you allowable tax-free lump sums and your retirement income . The value of your pension pot is affected by changes in the value of the assets you invest in - such as shares, bonds and property - and it will go ...

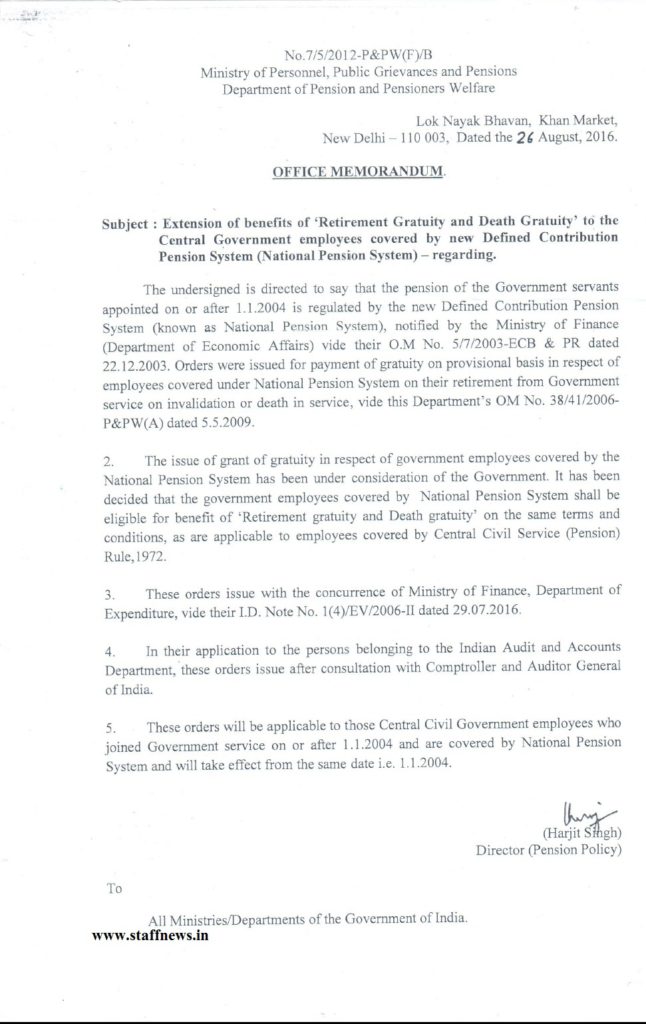

How To Get Widows Pension Income After Death Of Spouse The National Pension System (NPS) is a voluntary defined contribution pension system or government-sponsored pension scheme in India (like PPF and EPF). The scheme allows subscribers to contribute regularly to a pension account during their working life. The entire corpus escapes tax at maturity and the entire pension withdrawal amount is tax-free.

Options for using your defined contribution pension pot You now have more choice and flexibility in how and when you can take money from your defined contribution pension pot. It’s important to understand your options because what you decide now will affect your retirement income for the rest of your life.

0 Response to "39 defined contribution pension death"

Post a Comment