40 jp morgan oil price forecast 2022

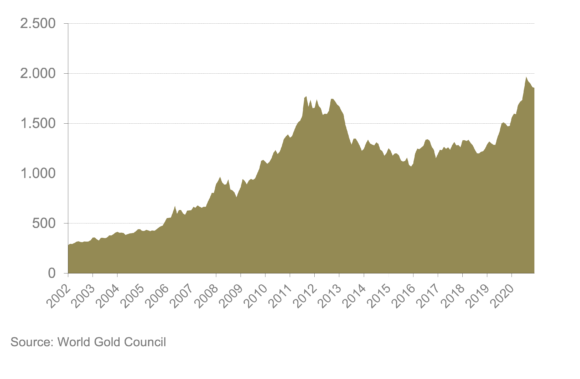

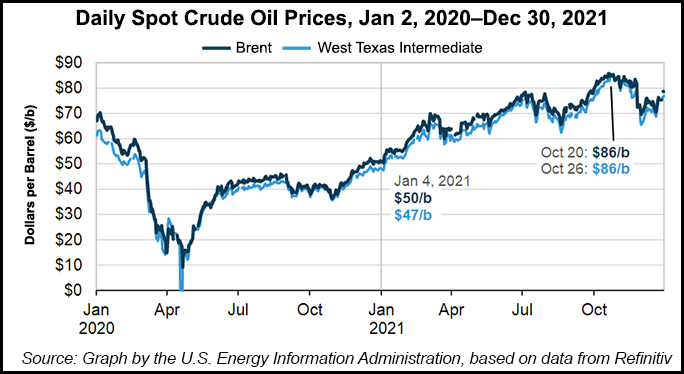

Stock Market Today: Futures Fall Ahead of Inflation Data In the two weeks since Russia invaded Ukraine, the price of oil has risen by 18% to around its highest in 14 years. Gold was down slightly, as it lost 0.04% to $1,987.50 on Thursday. JP Morgan Predicts The End Of Covid, A Strong Economy, And ... A vibrant economy means robust demand for oil, and JP Morgan even said last week that crude oil prices could soar to $125 per barrel in 2022 and $150 in 2023 due to OPEC's limited capacity to boost...

› articles › nigeria-sues-jp-morganNigeria sues JP Morgan for $1.7 billion over oil deal | Nasdaq Feb 23, 2022 · A London court will on Wednesday begin to hear a lawsuit launched by Nigeria against U.S. bank JP Morgan Chase, claiming more than $1.7 billion for its role in a disputed 2011 oilfield deal.

Jp morgan oil price forecast 2022

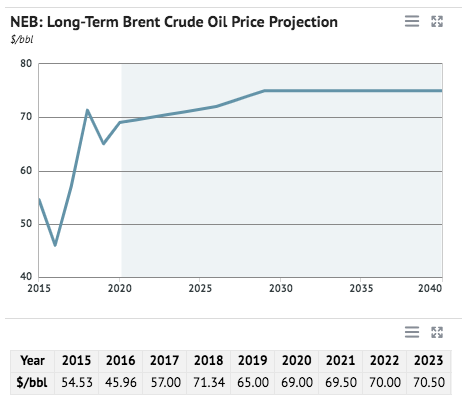

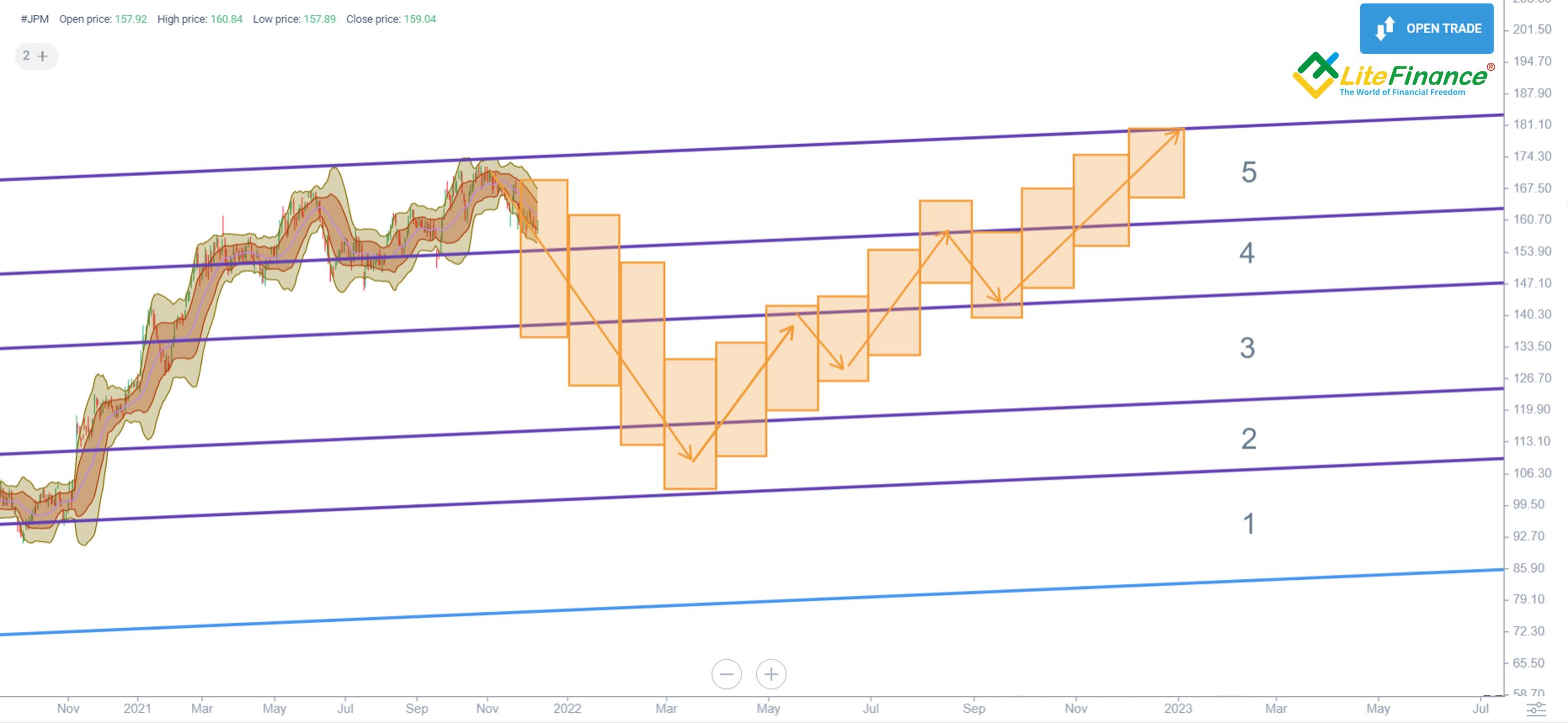

JP Morgan sees OPEC spare capacity falling through 2022 ... JP Morgan on Wednesday said it expects Organization of Petroleum Exporting Countries' spare capacity to fall through 2022, driving a higher risk premium to oil prices. JPM forecasts oil prices to rise as high as $125 a barrel this year and $150 a barrel in 2023. "We see growing market recognition of global underinvestment in supply," the bank said. Oil Will Hit $125 a Barrel in 2022, $150 in 2023: JPMorgan Oil Will Hit $125 a Barrel in 2022, $150 in 2023: JPMorgan OPEC production shortfalls will spark the move, J.P. Morgan says. 'OPEC+ is not immune to the impacts of underinvestment.' Jpmorgan Chase & Stock Forecast & Predictions: 1Y Price ... On average, analysts forecast that JPM's EPS will be $11.11 for 2022, with the lowest EPS forecast at $10.50, and the highest EPS forecast at $12.10. On average, analysts forecast that JPM's EPS will be $12.40 for 2023, with the lowest EPS forecast at $11.45, and the highest EPS forecast at $13.23.

Jp morgan oil price forecast 2022. en.wikipedia.org › wiki › JPMorgan_ChaseJPMorgan Chase - Wikipedia JP Morgan Chase's PAC and its employees contributed $2.6 million to federal campaigns in 2014 and financed its lobbying team with $4.7 million in the first three quarters of 2014. JP Morgan's giving has been focused on Republicans, with 62 percent of its donations going to GOP recipients in 2014. JP Morgan Forecasts $125 Oil Price in 2022, $150/bbl in ... JP Morgan Forecasts $125 Oil Price in 2022, $150/bbl in 2023. Oil prices are expected to overshoot $125 a barrel next year and $150 in 2023 due to capacity-led shortfalls in the Organisation of ... Oil rally to power on as sanctions on Russia throttle ... Among the most bullish predictions, JP Morgan expects $185 oil by the end of 2022 if disruption to Russian exports lasts that long, although its average for the year was $98. JPMorgan's S&P 500 forecast for 2022 is among the most ... In our call of the day, JPMorgan predicts a 5,050 finish in 2022 for the S&P 500 SPX, which matches RBC's forecast and looks among the most optimistic on Wall Street so far. Read: Omicron may delay...

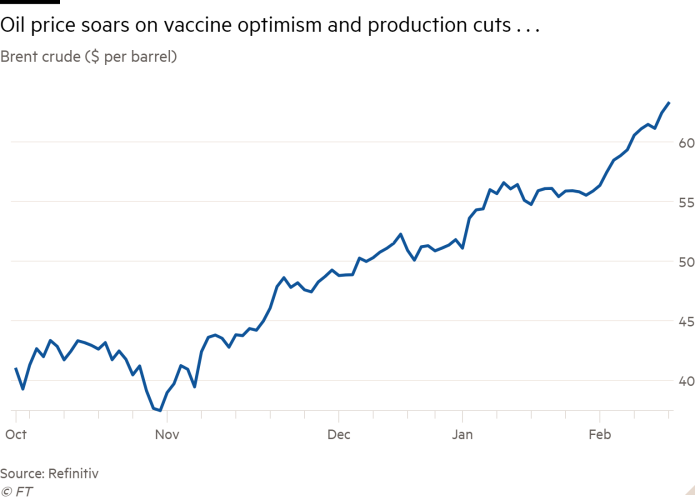

JP Morgan sees oil prices hitting $125 in 2022, $150/bbl ... JP Morgan sees oil prices hitting $125 in 2022, $150/bbl in 2023. - Oil prices are expected to overshoot $125 a barrel next year and $150 in 2023 due to capacity-led shortfalls in OPEC ... Soaring prices set stage for eventual reversal of oil, gas ... It raised its 2022 forecast by nearly 800,000 barrels per day, predicting a need for an additional 3.2 million bpd this year, to well above the 100 million bpd pre-pandemic level of 2019. › cryptocurrencies › newsJP Morgan enters metaverse, opens lounge in Decentraland and ... Feb 15, 2022 · Banking giant JP Morgan enters the metaverse with the launch of its Oynx lounge in Decentraland. ... 2/15/2022 10:02:35 PM ... Decentraland price posted double-digit gains as institutions drive ... oilprice.com › Energy › Energy-GeneralOil Prices Projected To Hit $125 In 2022 | OilPrice.com Nov 30, 2021 · In a new report from JP Morgan, analysts are predicting $125 oil next year and $150 oil in 2023 This bullish forecast is driven by the belief that OPEC has a limited capacity to increase oil ...

PDF Investment Outlook 2022 - am.jpmorgan.com quarter of 2021, should ease on average in 2022 as oil prices recede, supply chain difficulties diminish and government aid to low- and middle-income households dries up. Still, with strong wage growth, high inflation expectations and the lagged effect of higher home prices on rents, we expect inflation as Gas prices could double next year, JP Morgan oil analysis ... The J.P. Morgan analysis was published on Nov. 29 and is predicting crude prices will average $88 per barrel in 2022 before "overshooting" to the $125 price point. Malek's report said part of the... Oil price spikes to $139 on talks about Russia oil ban ... Global oil prices have spiked more than 60% since the start of 2022. JP Morgan analysts say oil could soar to $185. LONDON, United Kingdom - Oil prices spiked to their highest levels since 2008 ... JP Morgan sees oil prices hitting $125 in 2022, $150/bbl ... JP Morgan sees oil prices hitting $125 in 2022, $150/bbl in 2023 | Reuters. Oil prices are expected to overshoot $125 a barrel next year and $150 in 2023 due to capacity-led shortfalls in OPEC+ ...

Oil will spike to $150 in 2023, JPMorgan predicts - CNN Importantly, JPMorgan is not calling for oil to trade at $125 a barrel for all of 2022. Instead, the bank is predicting crude will average $88 next year and "overshoot" to $125 at some point....

Oil price could rise to $125 per barrel in 2022, warns US ... US bank JP Morgan, in a new report, has revealed that the oil prices could surge by 66 per cent in 2022, which is US $125 per barrel. Crude oil could cost as much as US $150 per barrel by 2023.

Why are oil prices soaring? | J.P. Morgan Asset Management Going forward, its likely oil prices will remain elevated over the medium-term, keeping headline inflation above 3% through mid-2022. However, supply constraints should ease and inventories should gradually be rebuilt, allowing for inflationary pressures driven by higher oil prices to ease into 2023. Commodity prices Commodity price z-scores

JPMorgan (JPM) War-Games Economic Damage of an Oil Surge ... The price of oil hasn't even reached $100 a barrel, but that's not stopped economists at JPMorgan Chase & Co. from war-gaming what a surge to $150 -- this quarter -- would mean for the world ...

2022 Market Outlook | J.P. Morgan Global Research J.P. Morgan forecasts the Fed to finish tapering by mid-2022 and to start hiking 25bp quarterly in September 2022. J.P. Morgan Research expects Treasury yields to rise in 2022, with the intermediate sector (bonds with a maturity of 2-10 years) leading the way.

Factbox-JP Morgan says oil demand to surpass 2019 levels ... The bank expects global oil demand to grow 3.5 million barrels per day (bpd) in 2022 to reach 99.8 million bpd, which would be 280 kilo bpd above 2019 levels. The bank also expects Brent oil prices...

Commodities for Wednesday, March 9, 2022 - Video - BNN Commodities for Wednesday, March 9, 2022. The latest insight into the hot world of commodities and the companies that produce them, including interviews with mineral and mining entrepreneurs from Canada and around the globe. Add to Playlist.

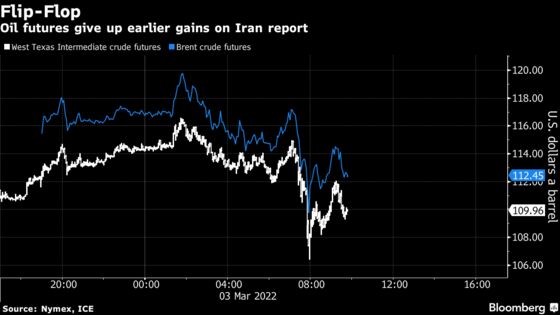

JPMorgan (JPM) Says $185 Oil in View If Russian Supply Hit ... March 3, 2022, 7:58 AM PST Brent crude could end the year at $185 a barrel if Russian supply continues to be disrupted, JPMorgan Chase & Co. wrote in a note Thursday. Oil prices have skyrocketed,...

Record Prices JP Morgan Predicts Oil Could Hit a Record ... The latest Tweet by Reuters states, 'Record prices JP Morgan predicts oil could hit a record $185 a barrel by the end of 2022 if disruption to Russian exports lasts that long, although along with most analysts polled by Reuters the bank expects a yearly average price below $100' 🌎 Record Prices JP Morgan Predicts Oil Could Hit a Record $185 a Barrel by the End of 2022 ...

› stocks › quotesJPM - JP Morgan Chase & Company Stock Price - Barchart.com Price/Cash Flow: Latest closing price divided by the last 12 months revenue/cash flow per share. Price/Book: A financial ratio used to compare a company's current market price to its book value. Price/Earnings: Latest closing price divided by the earnings-per-share based on the trailing 12 months. Companies with negative earnings receive an "NE."

Oil rally to power on as sanctions on Russia throttle ... Among the most bullish predictions, JP Morgan expects $185 oil by the end of 2022 if disruption to Russian exports lasts that long, although its average for the year was $98. The highest average predictions for 2022 were Rabobank and Raiffeisen with $111.43 and $110 respectively.

What's Next For Oil And Gas Prices As Russia-Ukraine ... J.P. Morgan Research price forecasts for the first quarter of 2022 (1Q) remain at 75 euro/MWh, 55 euro/MWh in 2Q and 45 euro/MWh in 3Q, but price risks to the upside are clearly present.

Outlook 2022: Preparing for a vibrant cycle | J.P. Morgan ... The foundation for a vibrant cycle. The global crisis has shifted policymaker priorities, solidified household and corporate balance sheets, and embedded innovation. This should set the table for more potent economic growth in the 2020s than we saw in the 2010s. USD4 trillion U.S. Government has spent in response to the pandemic 1.

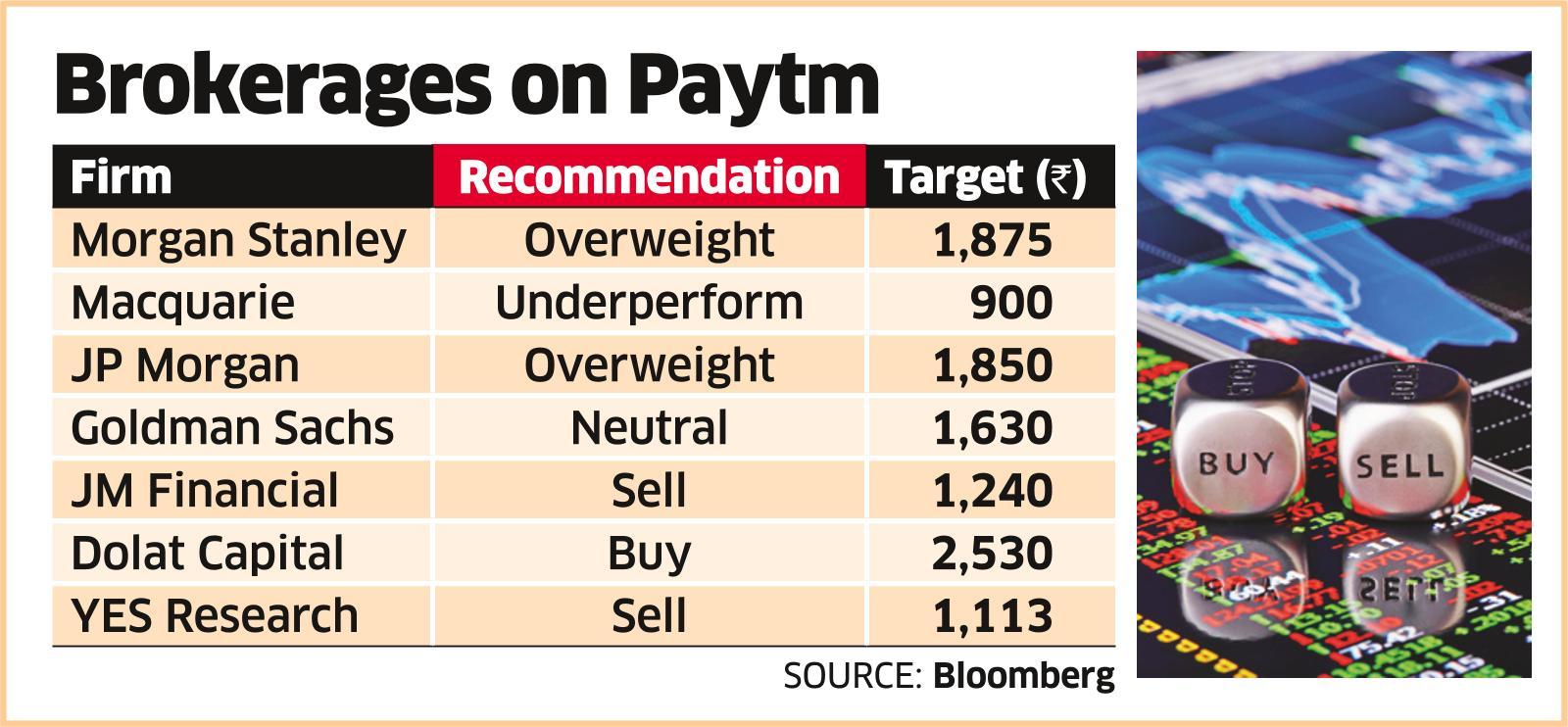

Analysts expect oil to breach $100 in 2022 - Businessday NG Analysts expect oil to breach $100 in 2022 Oladehinde Oladipo Jan 24, 2022 Morgan Stanley said the commodity will continue to experience price pressures on the expectation that stockpiles will further deplete towards the end of 2022 after an already weak 2021. Global benchmark Brent crude has gained more than 25percennt t0 $88 in January.

Jpmorgan Chase & Stock Forecast & Predictions: 1Y Price ... On average, analysts forecast that JPM's EPS will be $11.11 for 2022, with the lowest EPS forecast at $10.50, and the highest EPS forecast at $12.10. On average, analysts forecast that JPM's EPS will be $12.40 for 2023, with the lowest EPS forecast at $11.45, and the highest EPS forecast at $13.23.

Oil Will Hit $125 a Barrel in 2022, $150 in 2023: JPMorgan Oil Will Hit $125 a Barrel in 2022, $150 in 2023: JPMorgan OPEC production shortfalls will spark the move, J.P. Morgan says. 'OPEC+ is not immune to the impacts of underinvestment.'

JP Morgan sees OPEC spare capacity falling through 2022 ... JP Morgan on Wednesday said it expects Organization of Petroleum Exporting Countries' spare capacity to fall through 2022, driving a higher risk premium to oil prices. JPM forecasts oil prices to rise as high as $125 a barrel this year and $150 a barrel in 2023. "We see growing market recognition of global underinvestment in supply," the bank said.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/44JBS2H7ONIJ5GYHSDXFXJZ22E.png)

0 Response to "40 jp morgan oil price forecast 2022"

Post a Comment